1 min read

Weather You Need Production Control (And We Did Spell That Correctly)

Update 09/03/19: today, as we post this blog, Hurricane Dorian is sitting over the Bahamas. Little is yet known about how much damage has been done...

Do you know what it costs to produce a single part, complete a single process or ship your product out the door? Have you considered labor cost? Machine cost? Over-runs, non-conformances and work delays in this number?

If you have all this information at hand, do you also track it over time and across your product line(s)? If you don't have access to it, do you have enough information to estimate the cost and price each product you make accordingly? Can you provide accurate estimates to your customer or do you rely mostly on instinct while padding your estimates to ensure on time delivery? How much business do you miss out on if you don’t have an accurate estimate of your cost and lead times?

Too many questions?

Fear not. There are ways to improve the visibility of your shop floor. Some are easier and faster than you might think.

Start by identifying the components of cost estimation and lead times. Then, identify the tools needed to bring those components together. To get you started, let’s focus on the components you need.

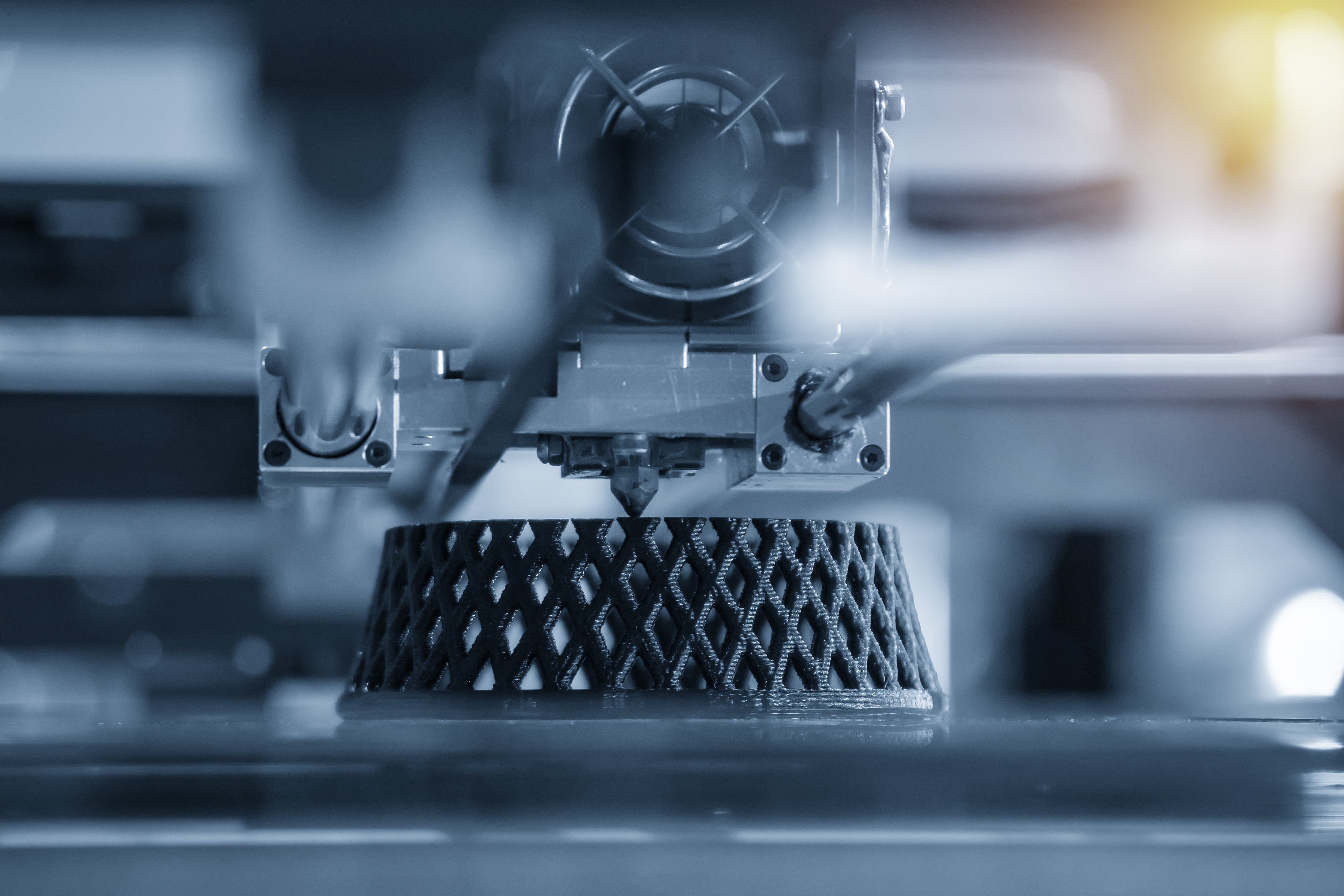

Materials

For starters, you have to know what parts and materials are required in the production of your products. Whether that's a series of materials driven into a constantly moving process or parts and materials being treated, formed, drilled, pressed and stamped into part production, build a complete list of the asset you have and need to complete your work and what they cost.

Your sourcing department will know what they purchase for your work and how much they spend to help you build your materials list. Identifying cost down to the individual parts produced on the shop floor is a little trickier.

Volume

You’ll then need to capture the amount of materials used for each production order and compare that to the amount of scrap each production run generates. Scrap drives up the cost of work not just by generating product you can't ship, but generally you must do the work twice either through a rework process or through starting over. Both are costly for your inventory team.

Time

You also need to know how much time each operator is spending. This can be as easy as doing a small time study or may need a closer eye on the productivity of each work cell and how work flows through it.

Many manufacturers have their employees record the time they spent after they’ve completed the work. This is certainly a good start but not recommended as a long-term solution. These records tend to be an estimate or incomplete. Research systems out there which can automatically record the hours spent on the work.

Analysis

Once you’ve identified what materials you need, the quantities of each for each product that you make and the time it takes to complete the build or production process, you have the start of a good costing analysis.

There are many parts of this process that can be completed by consultants or outside parties. The information they can generate is valuable, but the work is unsustainable. As soon as you complete the study, the information ages.

Moving forward, you may want to investigate a system to do this work for you automatically. Putting a digital trail in gives you the ability to track these measures over time, keep your finger on the pulse and push forward to quoting work that is consistently profitable for your organization.

This work will ultimately lower your costs, improve your efficiency and drive up productivity.

We believe in the critical importance of manufacturing right here in North America and we work hard to keep you working. Ask us questions; you will find that we are far more reachable than other software providers you may partner with. We are here to help you find the right tools and use them, whether it's a Google doc, an Excel sheet or a Production Control system. To learn more about meeting your targets for 2020 or just getting a question answered, visit us at www.cimx.com.

1 min read

Update 09/03/19: today, as we post this blog, Hurricane Dorian is sitting over the Bahamas. Little is yet known about how much damage has been done...

We’ve talked before about decision methodology. In brief, the theory we follow for manufacturers is that to stay competitive, you must always make...

1 min read

I heard someone in an interview the other day say consumers wanted things to return to pre-COVID levels. The speaker believed that people didn’t care...